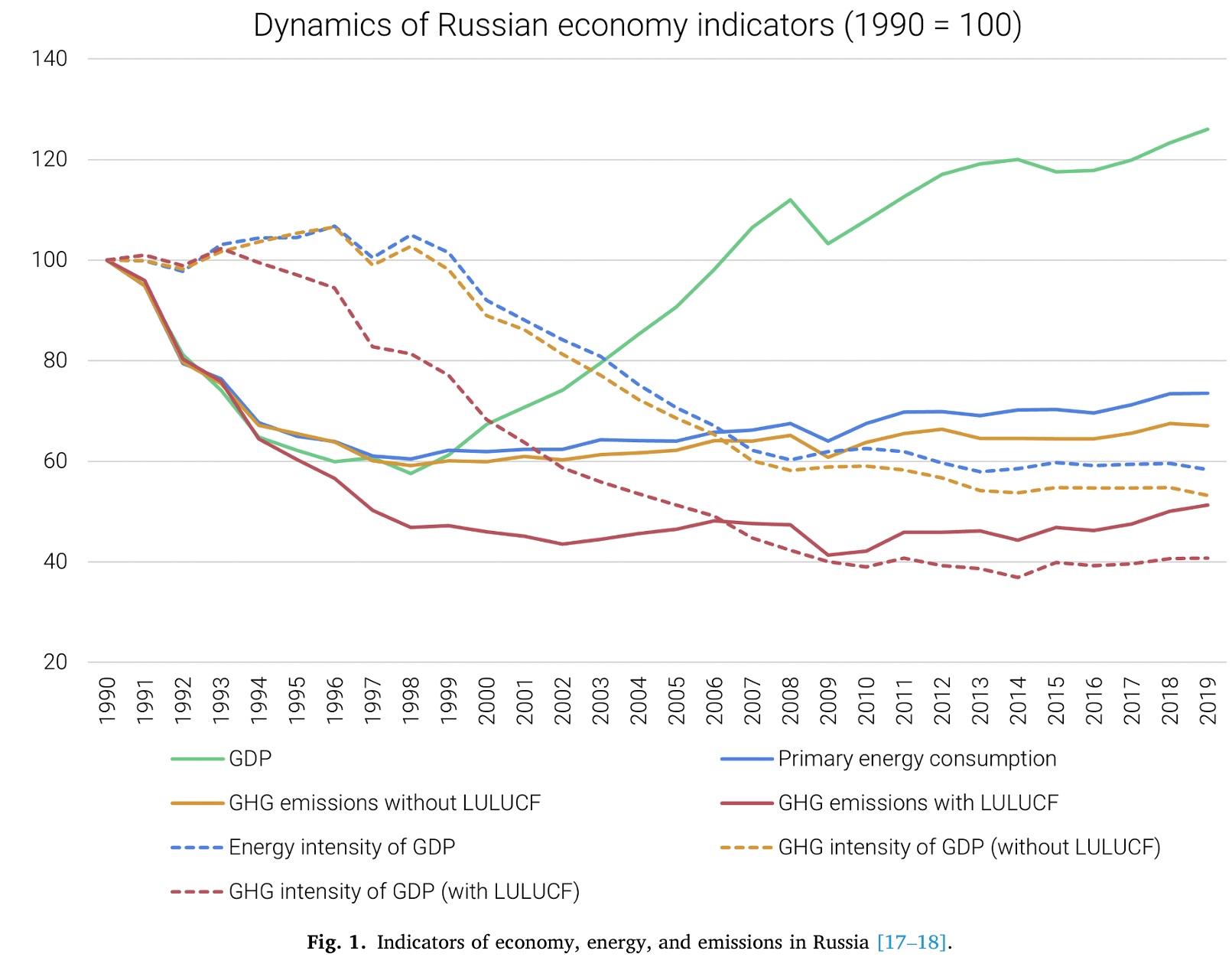

Between 1990 and 2019, Russia had halved its GHG emissions, with 2019 emissions at 2.1 GtCO2e with carbon dioxide (CO2) emitted during energy consumption representing the bulk, alongside methane CH4 from oil and gas infrastructure, waste and nitrous oxide (NO) from agriculture.

As previously mentioned, Russia’s energy mix includes natural gas, nuclear, some coal, oil and approximately 4% from renewable sources. high GHG emissions are from development and export of hydrocarbons internationally. Revenues from exports have partly been used for research, development and technology imports to reduce future emissions. Land use and forestry (LULUCF) help mitigate overall national emissions, approximately 25% (Shirov et al., 2023). Russia needs to continue to develop and where necessary, import additional technology and expertise in the future.

A national online workshop was held with over 100 stakeholders by the Institute of Economic Forecasting of the Russian Academy of Sciences (IEF RAS). The workshop was part of a wider international climate research project – PARIS REINFORCE. They used a quantitative modelling tool – CONTO, to run scenarios and evaluate future decarbonisation. They evaluated low carbon technologies and applicability to the manufacturing industries. Carbon sequestration potential from e.g. Russian forests were analysed and input into the scenarios. The workshop produced two types of scenarios – weighted average mitigation (WAM) and most ambitious mitigation (MAM) scenarios.

Energy generation broadly varies across Russia with gas and nuclear in European Russia whereas coal and hydroelectric power (HEP) are more prevalent in Asian Russia. They believe that replacement of coal with natural gas will begin after 2040 and decarbonisation of thermal power plants until 2040. They also believe they can improve efficiency and reduce emissions of natural gas during these decades.

They don’t forecast an investment climate that supports renewables reaching greater than 11% until at least 2050 due to uncertainty, high levels of risk particularly with technology imports and impact of COVID-19 and international sanctions. GDP predictions vary with 2.29% average growth (WAM) compared with 1.97% (MAM) due to lower imports. They believe overall they can continue to reduce emissions and decarbonise existing hydrocarbon industries rather than replace unless the international economic conditions change. However domestic technology development may improve these forecasts.

Shirov, A.A., Kolpakov, A.Y., Gambhir, A., Koasidis, K., Köberle, A.C., McWilliams, B. and Nikas, A., 2023. Stakeholder-driven scenario analysis of ambitious decarbonisation of the Russian economy. Renewable and Sustainable Energy Transition, p.100055 https://doi.org/10.1016/j.rset.2023.100055

One Comment Add yours